Payment gateway is an online payment service provider. For example, if we shop at Shopee during checkout, we can choose to pay online banking (FPX) or using debit or credit cards.

So the party that provided the FPX payment channel or the card was the payment gateway provider. Without a payment gateway, it’s impossible for you to pay at Shopee and Shopee may not be used by many because there are no online payments.

In the world of e-commerce, payment gateways are a very important component. If you want to do business online with an e-commerce website, if you do not have a payment gateway, then your website is incomplete. Yes, you can still use cash on delivery (COD) or have just paid, but you will lose a lot of customers because the majority of Malaysians prefer to pay online.

If you already have a website for your business but are still wondering what payment gateway to use, maybe this article can help. In Malaysia, there are many payment gateway providers, such as:

CHIP – click to CHIP website

ToyyibPay – clik to Toyyibpay website

SenangPay – click to SenangPay website

Among online traders through e-commerce websites in Malaysia, ToyyibPay is actually very popular. This is because opening an account with ToyyibPay is very fast and easy. After you register, you can continue to use ToyyibPay for your e-commerce website. If you only want your customers to pay using FPX (online banking), ToyyibPay is an easy and fast option.

BUT, if you want customers to pay by card, ToyyibPay may not be the best because, at the time this article was written, they still use the SenangPay platform, which requires you to pay an onboarding fee (not free), and there is also an annual fee.

No website yet? Click here to get the service for the website.

In this article, we will touch on CHIP, a payment gateway provider you may not have heard of, but it is getting popular in Malaysia.

To start receiving online payments from customers on your website, opening an account at CHIP is very fast and easy, just like with ToyyibPay. Register and you’re good to go.

Any transaction using CHIP, payment, or settlement will be processed within 1 working day (T+1) to your bank account. It means that if your customers pay today, tomorrow they’ll be in your bank account. But, aren’t the other payment gateways doing that too?

Yeah, but at CHIP, if your bank account is Maybank, even if tomorrow is a holiday or even a public holiday, your money will still be in.

Coming soon, CHIP will accelerate the settlement period by the next day (as early as 2 a.m.). You woke up in the morning, and the settlement got into the bank account!

Other payment gateway providers, although they have the same transaction fee (RM1), require you to pay an onboarding or yearly fee to accept payment by credit or debit card. For example, you have to pay from RM100 to RM360 a year on ToyyibPay but with CHIP, no.

Besides, payment or settlement for card payment in CHIP is very fast, taking only 2 working days.

If your business has a recurring payment model, CHIP is the right choice for your business. For example, if you provide online tuition services where students need to pay monthly fees, CHIP can enable this payment mode automatically.

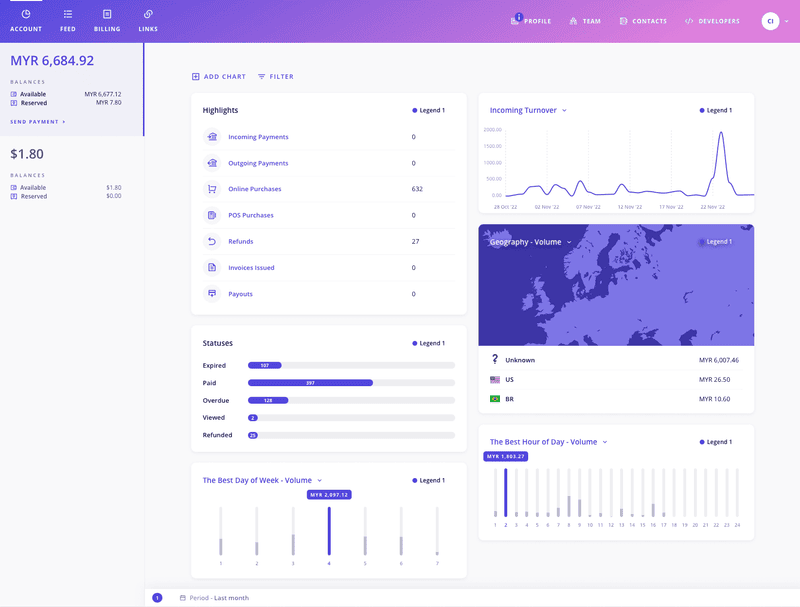

With CHIP, you can see payment statistics in very detail, and you can get a custom statement for your business study using the data available on the CHIP dashboard. If you are concerned about access issues, you can create special roles in the CHIP dashboard and assign your employee or staff to view your business data.

In terms of design, if you’ve ever used Stripe, the international payment gateway, you’ll get the same “vibe” on CHIP.

If you have any problems, the CHIP support team is very responsive. They’ll put you in a special WhatsApp group in which there’s only you and the CHIP support team. In addition to the WhatsApp group, you can also contact CHIP via email and telephone, but according to our experience, the support through the WhatsApp group is also quite satisfactory.

CHIP will send you a very detailed report whenever there is a payment or settlement. Your company’s finance department just needs to refer to the report to make a reconciliation. Your company’s finance party will love it.

Every online trader will not be free from receiving trouble with the customer, and there are times involving a refund to the customer for some reasons such as damaged goods, warranty, etc. With CHIP, it’s really easy to make a refund to your customers. Just click the refund button.

The CHIP platform is very reliable, which means that there is very rarely a downtime or server down. This is because Amazon Web Services, the best cloud provider in the world, dominates the CHIP platform.

In this cashless era, a lot of people use e-wallets. As a business owner, it is important for you to facilitate your customers as much as possible in terms of payment. With CHIP customers, you can pay with an e-wallet as well.

In addition to online business on the website, CHIP also supports payments if you run your business on site and also online. For example, you sell covers online, but you also have a physical store. Interestingly, CHIP can consolidate reports between your offline store and your online store.

In addition to the above features, CHIP will also add new functions in the future, such as CHIP Send, ChIP Expense, and Atome.

CHIP Send is a facility that allows you to make payments to your agents, dropshippers, or even vendors. You can also auto-split your payment with other accounts.

With CHIP Expense, you are happy to deal with petty cash, claims, or any expenses of the company.

In conclusion, if you have not yet had a payment gateway for your online or offline business, what’s wrong if you try CHIP? But it’s not wrong if you use more than one payment gateway.

Why?

For example, if you only use ToyyibPay, and if there is any problem with ToyyibPay, you can continue to change your payment gateway on your website to CHIP if you have a CHIP account. At least, we suggest you have at least two payment gateways. One backup.

Register CHIP accounts for your business. Click here to register.

No website yet? Get affordable website design starting at only RM37!